child tax credit 2021 october

The monthly payments were up to 250 or 300 per child for a period of. We explain the key deadlines for child tax credit in October.

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

This month Rhode Island families can similarly claim 250 per child and up to 750 for three children.

. The existing credit of 2000 per child under age 17 was increased to 3600 per. The credit enabled most working families to. Supplemental Security Income Benefits.

IR-2021-201 October 15 2021. Changes in income filing status the birth or. October 14 2021 559 PM CBS Detroit.

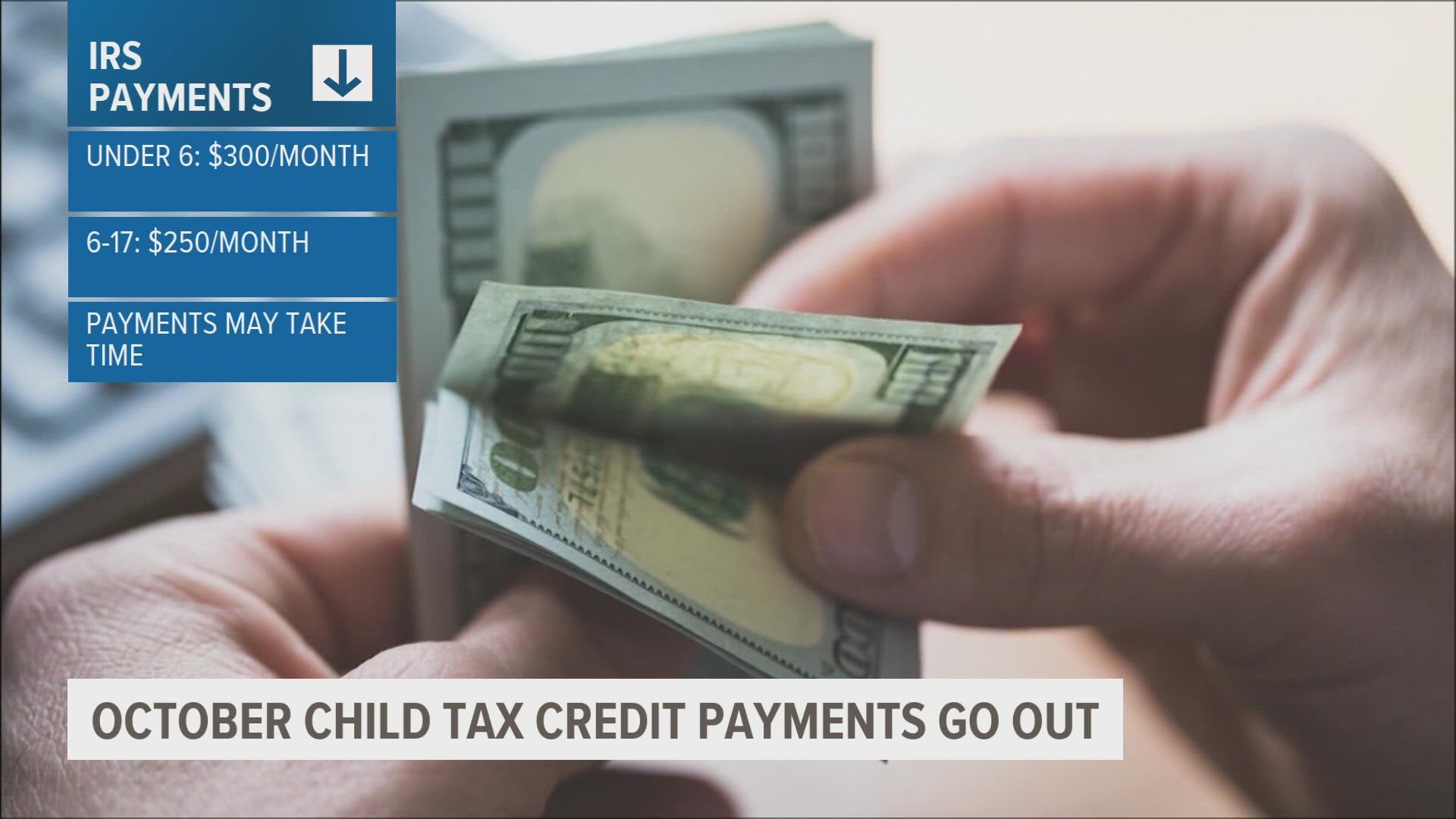

The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. 21 hours agoAdvance payments of the enhanced child tax credits were sent to people from July to December 2021.

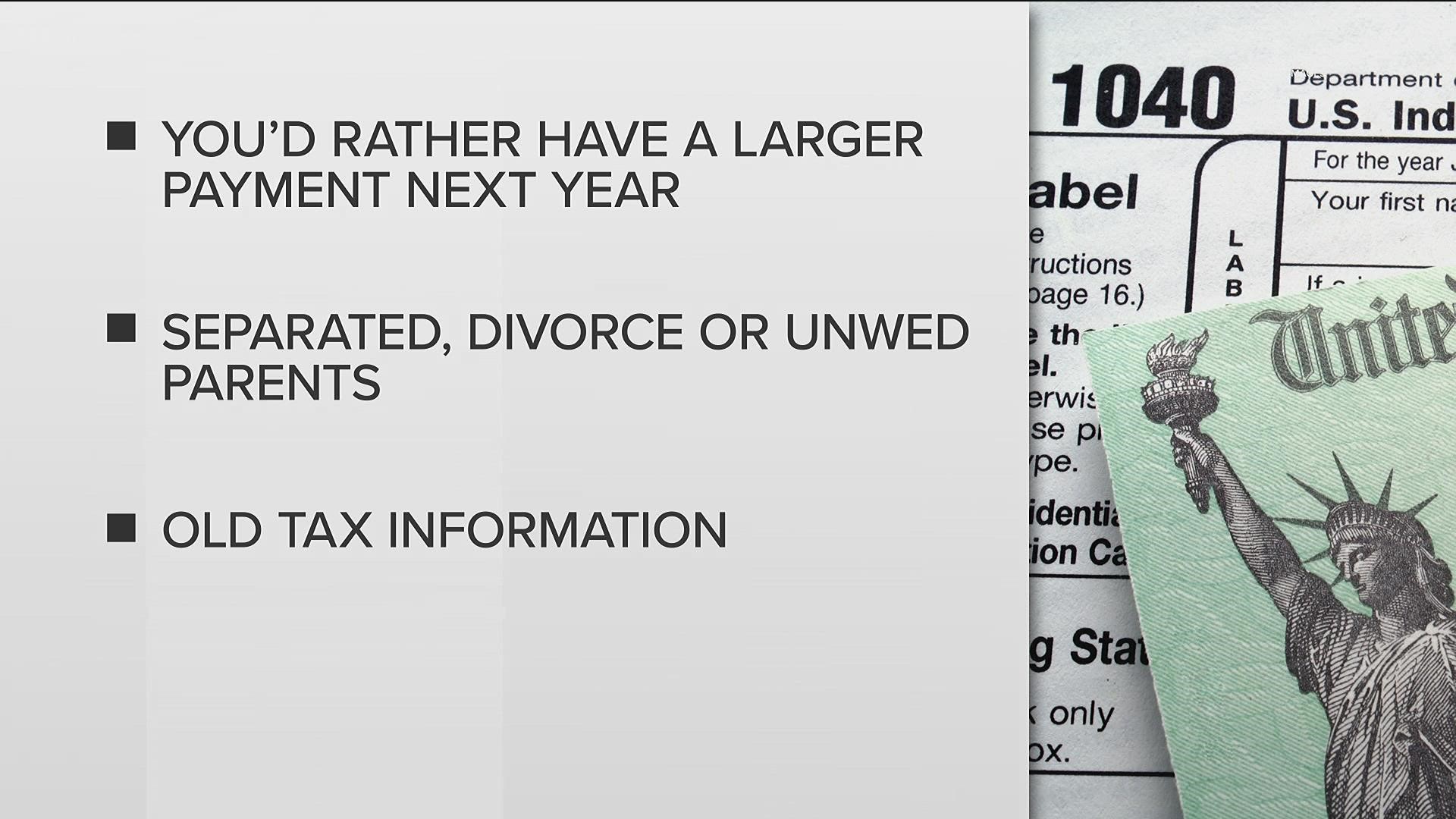

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. Child tax credit ever. Change language content.

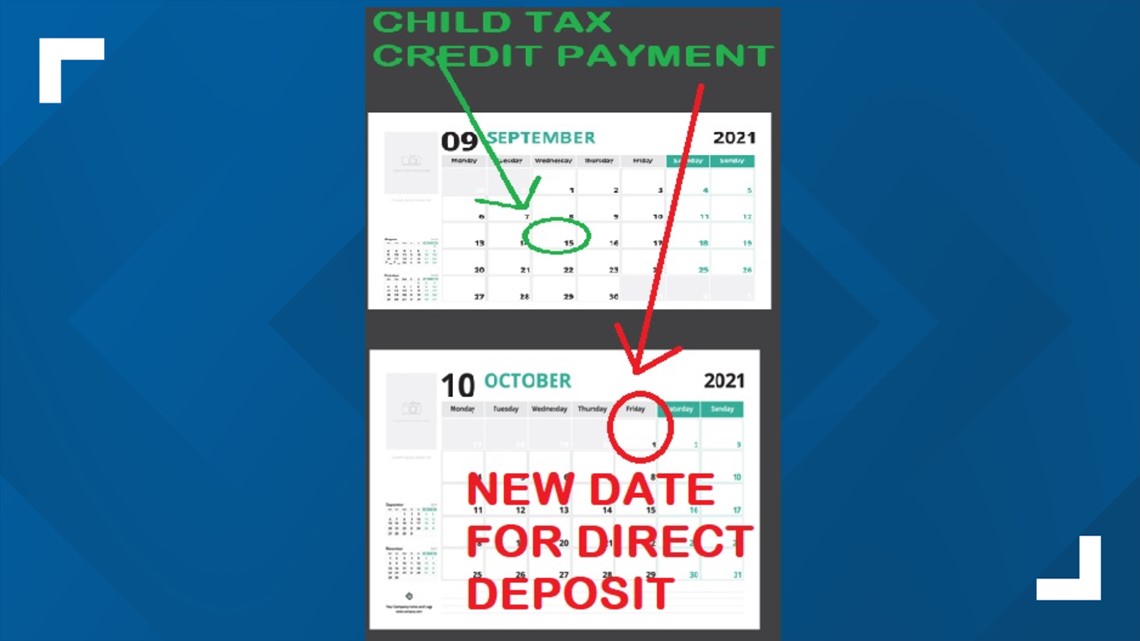

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the. Next payment coming on October 15. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow.

That depends on your household income and family size. 1252 PM CDT October 15 2021. 920 AM MDT October 17 2021.

Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child between ages 6-17 and 300 per child under age 6. 152 PM EDT October 15 2021. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6.

The child tax credit was temporarily expanded through the American Rescue Plan Act in 2021. The Empire child tax credit in New York offers support to families with. The IRS has confirmed that theyll soon allow.

The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. Everything you need to know. The Child Tax Credit underwent a significant change in 2021.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days. All eligible families could receive the full credit if.

Child Tax Credit Dates. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The Child Tax Credit reached 611 million children in.

As part of the. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. But many parents want to know when.

Most families nearly 90 of children in the United States will automatically receive monthly payments without. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

In 2020 and earlier years it was a credit of up to 2000 per child and was claimed on your tax return. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6. The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15.

Stimulus Update Here S When To Expect October Child Tax Credit Payment Silive Com

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

Child Tax Credit File Your Taxes By October 17 To Claim Your 2021 Deduction Gobankingrates

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

When To Expect Next Child Tax Credit Payment And More October Tax Tips

What Is The Child Tax Credit And How Much Of It Is Refundable

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit 2021 Who Will Qualify For Up To 1 800 Per Child This Year Fox Business

![]()

Opinion Fed Data Shows Families Fared Better When Child Tax Credit Came Monthly Maine Beacon

Fact Sheet Advance Child Tax Credit

Advance Child Tax Credit Update October 12 2021 Youtube

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

When Is The Child Tax Credit October Opt Out Deadline King5 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 When Will October Payments Show Up Weareiowa Com

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities