what is suta tax rate

Usually the net federal unemployment tax rate after applying such credit is 08 for 2005. The Oregon Employment Department mails notifications to businesses regarding their individual tax rates and encourages employers to wait until they receive their individual notice before attempting to contact the.

Futa Tax Overview How It Works How To Calculate

This means the effective federal tax rate is 06 percent.

. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. The contribution rate. Employer UI tax rate notices are available online for the following rate years.

24 new employer rate Special. 0540 54 or 378 per employee. Taxable wage base.

52 rows An employers SUTA rate is often referred to as a contribution rate. 0010 10 or 700 per employee. Many states give new employers a standard new employer SUTA rate.

Employers in 2022 will face an unemployment tax rate of zero or higher. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office. Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows.

Federal Unemployment Tax Act FUTA - What is Federal Unempl Economy. Since the wage base in New York for 2021 was 11800 your tax payment for your worker would be 004025 times 11800 for the year or. SUTA dumping involves the manipulation of an employers UI tax rate andor payroll reporting to owe less in UI taxes.

The amount of taxes you have paid. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated employers select the year. The EDD notifies employers of their new rate each December.

Taxable base tax rate. The 2022 wage base is 7700. The Office of UC Tax Services plans to issue the Contribution Rate Notice for calendar year 2022 Form UC-657 no later than December 31 2021.

Each state typically has a range of SUTA rates eg 065 68 in Alabama. You can view your tax rate by logging in to the Departments Reemployment Tax file and pay website. Louisiana Unemployment Insurance Tax Rates.

Employers new to the job are eligible to apply for unemployment tax either 1 percent or 20 percent. Payroll less than 500000. What Is The Sui Tax Rate For 2022.

Several factors are considered when calculating SUTA rates including 3301. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. New employers pay 34 percent 034 for a period of two to three years.

This rate is subject to change any time the rate schedule changes. 2022 PDF 2021 PDF 2020 PDF. After that you may be eligible for a higher or lower tax rate depending on.

A 33 increase in 2022 11 is forecast. Details of Tax Revenue - United States rated tax schedules. You have an employee who makes 45000 a year.

There are two types of UI tax rates new employer rates and earned rates. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025. 2011 2012 2013 Lowest Experience Rate.

FUTA is federally managed and states regulate SUTA. Each employer is also responsible for a Departmental Administrative Contingency Assessment DACA surcharge of 006 percent which is added to the base rate and interest surcharge. When you register as an employer your state will generally tell you what your SUTA tax rate is.

Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. The current newly subject employer rate for employers in the non-construction industry is 242 according to UI Tax Rate Schedule E in effect for 2022. The federal government applies a standard 6.

The UI rate schedule and amount of taxable wages are determined annually. Earned rates are assigned to employers with one or. Payroll greater than 500000.

State Unemployment Tax Act SUTA avoidance or dumping is a form of tax avoidance or UI tax rate manipulation through which employers dump higher UI taxes by attempting to obtain a lower rate. 52 rows The tax rates are updated periodically and might increase for businesses in certain industries. 52 rows Most states send employers a new SUTA tax rate each year.

Total Tax Rate Base Rate Solvency Surcharge zero DACA. South Carolina laws governing the tax rate assignment do not have an appeal process. The new employer rate is assigned to employers who have less than one fiscal year July 1 to June 30 of reporting experience.

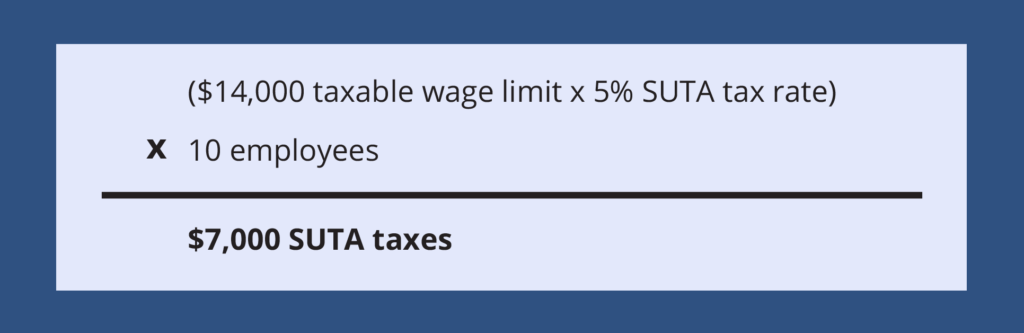

When the United States Department of Labor certifies that the states unemployment compensation program meets federal requirements employers that pay their state unemployment tax on time and in full receive a 54 percent credit to be applied against their FUTA tax rate. The new employer SUI rate is different in each state. Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever.

The Federal Unemployment Tax Act or FUTA IRC. If you are a new employer other than a successor to a liable employer you are assigned a tax rate of 20 percent for a minimum of two calendar years. In 2021 the country is expected to grow by 4.

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

What Is The Federal Unemployment Tax Rate In 2020

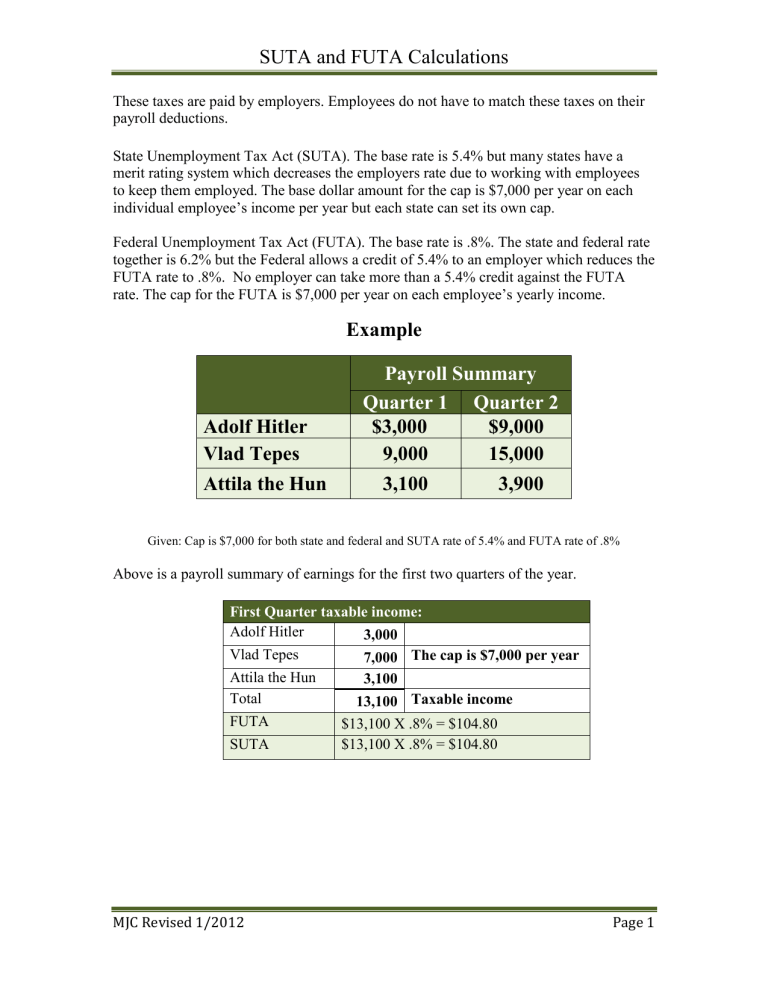

Systems Understanding Aid 9th Edition Suta And Futa Calculations

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

What S The Cost Of Unemployment Insurance To The Employer

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

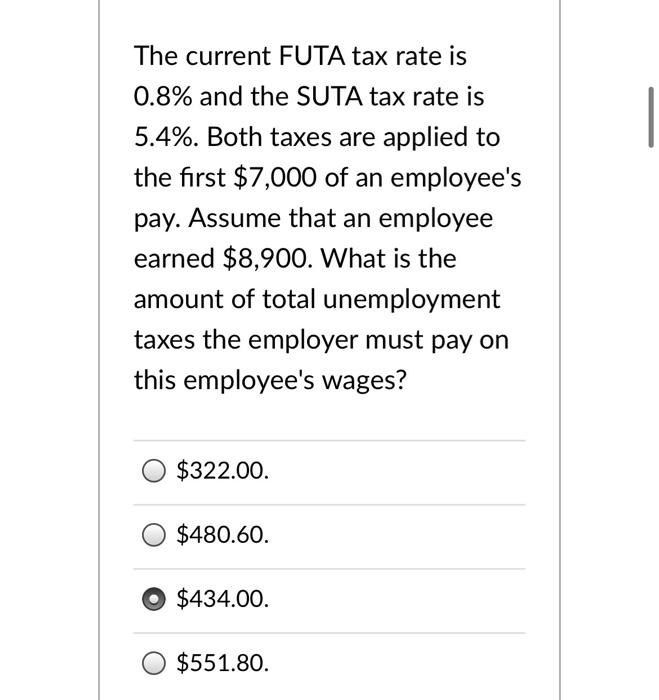

Solved The Current Futa Tax Rate Is 0 8 And The Suta Tax Chegg Com

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

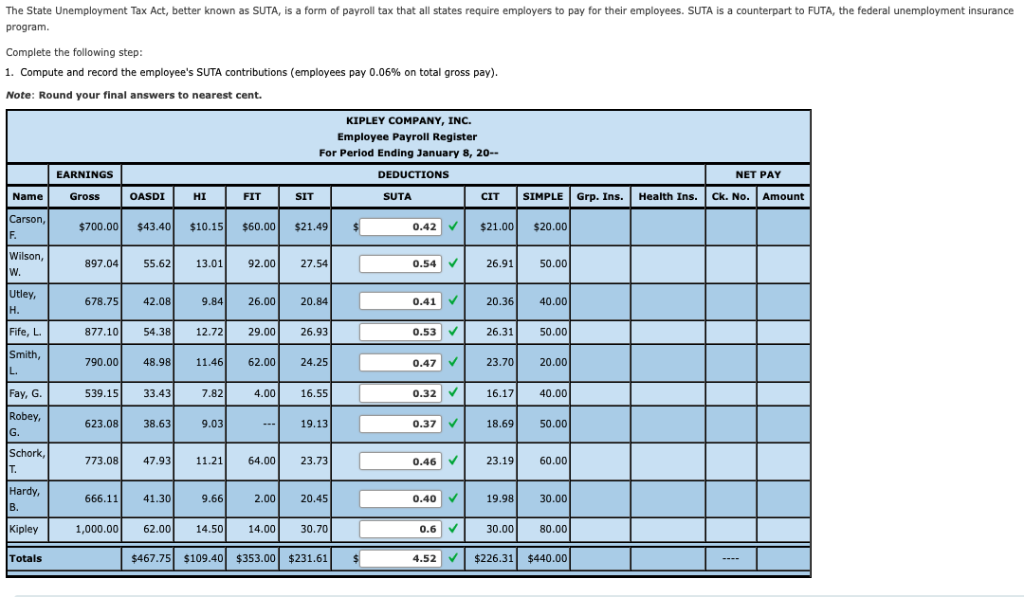

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Futa Suta Unemployment Tax Rates Procare Support

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Oed Unemployment Ui Payroll Taxes

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

.jpg)